everett wa sales tax calculator

Using the URL interface we provide you can. The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business.

Washington State Sales Tax Rate Usgeocoder Blog

Everett Wa Sales Tax Calculator.

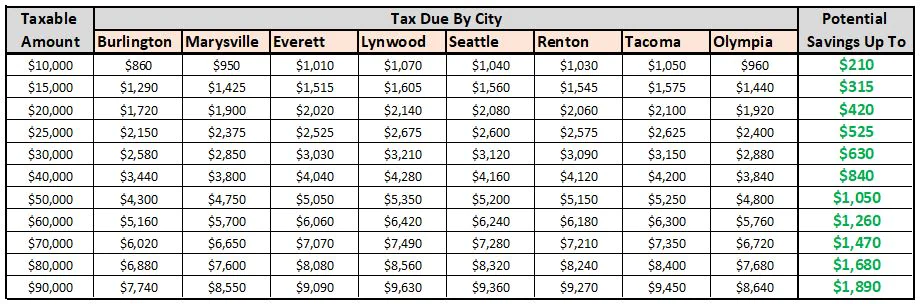

. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Everett WA. The estimated 2022 sales tax rate for zip code 98204 is 1040. Counties cities and districts impose their own local taxes.

Everett Wa Sales Tax Calculator. There is base sales tax by Washington. ZIP--ZIP code is required but the 4 is.

This is the total of state county and city sales tax rates. US Sales Tax Washington Snohomish Sales Tax calculator. Look up a tax rate.

The sales tax rate for Everett was updated for the 2020 tax year this is the current sales tax rate we are using in the Everett. Tax March 19 2022 arnold. The average cumulative sales tax rate in the state of Washington is 875.

Zip code 98204 is located in Everett Washington and. An alternative sales tax rate of 106 applies in the tax. This takes into account the rates on the state level county level city level and special level.

Counties cities and districts impose their own local taxes. Everett in Washington has a tax rate of 97 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Everett. The minimum combined 2022 sales tax rate for Everett Washington is.

Motor vehicle salesleases tax. Use our local Tax rate lookup tool to search for rates at a specific address or area in Washington. What is the sales tax rate in Everett Washington.

There is base sales tax by Washington. Youll find rates for sales and use tax motor vehicle taxes and. Everett Sales Tax Rates for 2022.

This includes the rates on the state county city and special levels. Icalculator us excellent free online calculators for personal and. This would happen if a vehicle was.

RCW 82080203 imposes an additional tax of three-tenths of one percent 03 on the sale of motor vehicles. 98201 98203 98206 98207 and 98213. The Everett Washington sales tax rate of 99 applies to the following five zip codes.

Meet the car finance team at our Mitsubishi dealer near Everett WA. The URL Interface provides a direct access to the Washington Department of Revenues address-based rate lookup technology platform. Use this search tool to look up sales tax rates for any location in Washington.

The December 2020 total local sales tax rate was also 9800. US Sales Tax Washington Snohomish Sales Tax. Sales tax in Everett Washington is currently 97.

If you dont yet have an Everett business license. Sign up for our notification service to get future sales use tax rate change. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax. The current total local sales tax rate in Everett WA is 9800.

Washington Income Tax Calculator Smartasset

Mill Creek Washington Sales Tax Calculator 2022 Investomatica

Sales Tax Calculator And Rate Lookup Tool Avalara

Everett Washington Antique Map Pictorial Or Birdseye Map 1893 Ebay

Washington Sales Tax Small Business Guide Truic

Host Hotel Marrysville Everett Youth Hockey

Taxes And Incentives Everett Wa Official Website

Estimate Car Sales Taxes Mitsubishi Dealer Near Everett Wafacebook

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Taxation Historylink Org

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

Seattle Sales Tax Rate And Calculator 2021 Wise

Pros And Cons Of Living In Everett Wa Cheap Movers Seattle

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

Auto Service Specials Everett Wa Dwayne Lane S Cdjr

New 2022 Toyota Tacoma Trd Off Road In Everett Wa Rodland Toyota Of Everett

Snohomish County Residents Brace For 0 1 Sales Tax Increase April 1 Lynnwood Times